As someone with an advisory role and financial interest in just such a business for the past ten years, the explanation provided by Apple’s CEO, Tim Cook, has a hollow ring:

“Small businesses are the backbone of our global economy and the beating heart of innovation and opportunity in communities around the world. We’re launching this program to help small business owners write the next chapter of creativity and prosperity on the App Store, and to build the kind of quality apps our customers love. The App Store has been an engine of economic growth like none other, creating millions of new jobs and a pathway to entrepreneurship accessible to anyone with a great idea. Our new program carries that progress forward — helping developers fund their small businesses, take risks on new ideas, expand their teams, and continue to make apps that enrich people’s lives.”

The suggestion that this is a natural evolution and being done out of the goodness of Apple’s corporate heart is implausible at best. The small businesses that rely on the App Store to reach iPhone customer have been “the backbone of the global economy and beating heart of innovation and opportunity” throughout the iPhone’s existence and have put up with being fleeced. The entrepreneurs have funded their businesses, taken risks on new ideas, expanded their teams and made apps that enrich people’s lives without any help from the black shirts* formerly of Infinity Loop, now Apple Park.

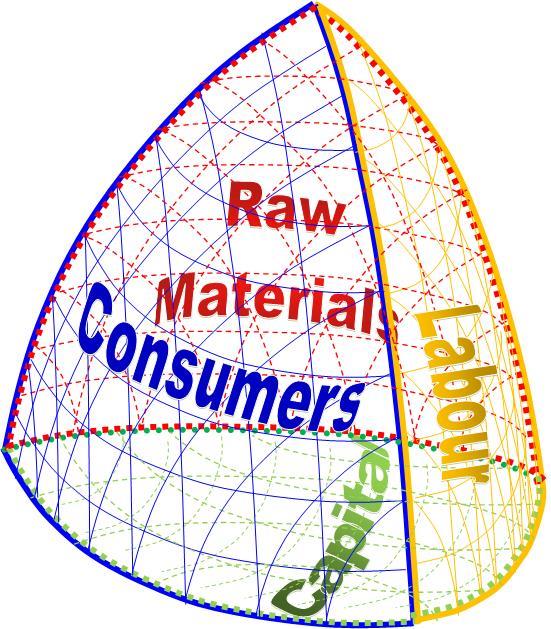

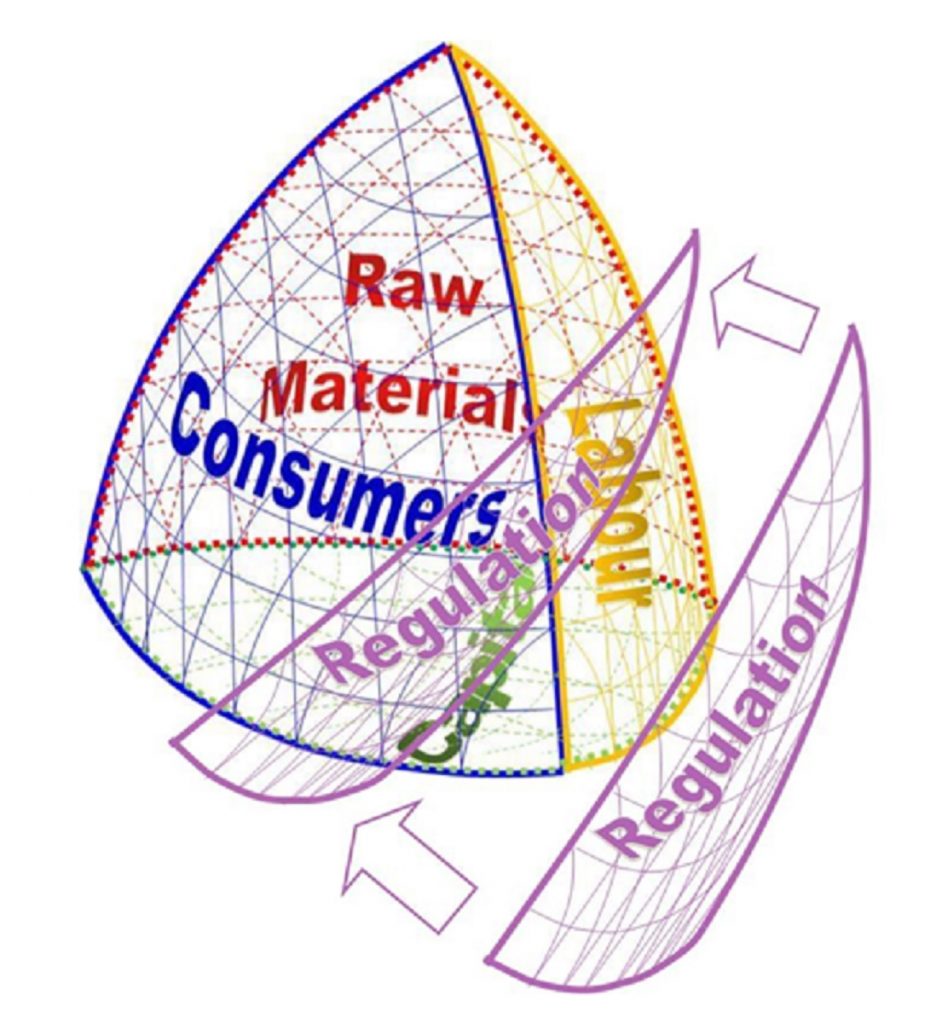

The likely explanation is provided by the threat of action from the European Commission, which opened an investigation into Apple’s anti-competitive behaviour in June, and potentially from the US, with Congressional hearings into the monopolistic conduct of the tech giants later in the summer. This is an illustration of the strategic solution space available to a company being reduced by the prospect of regulatory intervention.

In parallel with this reduction in the price charged to its small customers for using the App Store, Apple revealed at the Congressional hearings something about the shape of the market interface between the App Store and the “customers” who sell through it when it disclosed that it had agreed a 15% commission with Amazon for in-app charges within the Prime Video app.

The interesting question is what happens next. Apple has had to cave in to the threat of another web behemoth flexing its market power and potential to lobby against it. It has accepted, so far in part only with the new deal for smaller developers, the political reality of the forces gathering against its abuse of its power over a large slice of the market for apps on mobile phones. What of the middle-sized App Store developer customers? How long will it take Apple to develop an implausible but face-saving formulation to explain why it has reduced their commissions too? Or will it try to tough it out until competition authorities around the world run out of patience and take Apple, and potentially some of the other tech giants, apart in the way they did to the US rail and oil industry over a century ago?

* for the avoidance of doubt, this is a reference to the sartorial style of the late Steve Jobs and his successors and not a comment on either their conduct or politics.