How does the Escondido Framework interpret the impact of the decision of an employment tribunal in London that Uber drivers are not self-employed?

The Escondido Framework describes an organisation as both the solution space that exists between the external interfaces, or markets, and the structure, systems and processes within the solution space that mean that it creates value above and beyond what would exist in the absence of the organisation.

The first consequence of the employment tribunal was to address as matter of law as opposed to economics what Uber buys and sells. Uber hitherto has maintained that it provides a platform that brings together drivers and passengers – ie it provides a service that facilitates the provision of rides by self employed drivers to would be passengers who log on to the platform – rather it provides a transport solution to passengers using drivers that it employs. The judgement challenges the first model by effectively establishing that framework of the contract between the Uber and its drivers means that are being treated as though they were employees rather than self employed at arms length by the company.

The Escondido Framework is helpful in understanding how a judgement by lawyers considering employment lawyer can apparently transform the relationship between an Uber driver and Uber. Uber describes a relationship with the driver that makes them a customer of the company – a self-employed person who pays 25% of the fare secured to Uber in recognition of his or her use of the Uber platform. The Employment Tribunal found that, because of the constraints on the driver under the contractual relationship with company, the Uber driver is a supplier of labour – “an employee” – a factor of production in the provision of a minicab service by Uber to passengers.

The Escondido Framework is essentially neutral between the parties to a transaction: each is a customer of the other and is subject to terms that agreed in a contract of one sort or another, either explicit or implicit. Uber has certainly created value in creating and operating the platform, and thereby has created an organisation that occupies a virtual space bounded by market interfaces with drivers and passengers. Other interfaces bounding Uber’s virtual space include: those with its other employees – programmers and software engineers for example[1]; with its investors; and, as illustrated by this dispute and others with city transport authorities that license taxis, with the political and legal interfaces.

Given the restrictions on drivers, meaning that they cannot simultaneously be attached to multiple platforms, and that the passenger, although able to make choices among available drivers and vehicle classes, has relatively little ability to discriminate between drivers (I see a considerable contrast between Uber and other internet platform businesses such as eBay in this regards) it is hard to see Uber as a company selling a platform to users as opposed to selling journeys to passengers with drivers as employed labour, or at the very least suppliers that allow it to provide those journeys. In this interpretation, Uber is a very conventional organisation providing taxi services, with a highly efficient and well developed set of systems and processes that has created a lot of value, and in Escondido Framework language “solution space”, between the market interfaces of supplier/labour and customer.

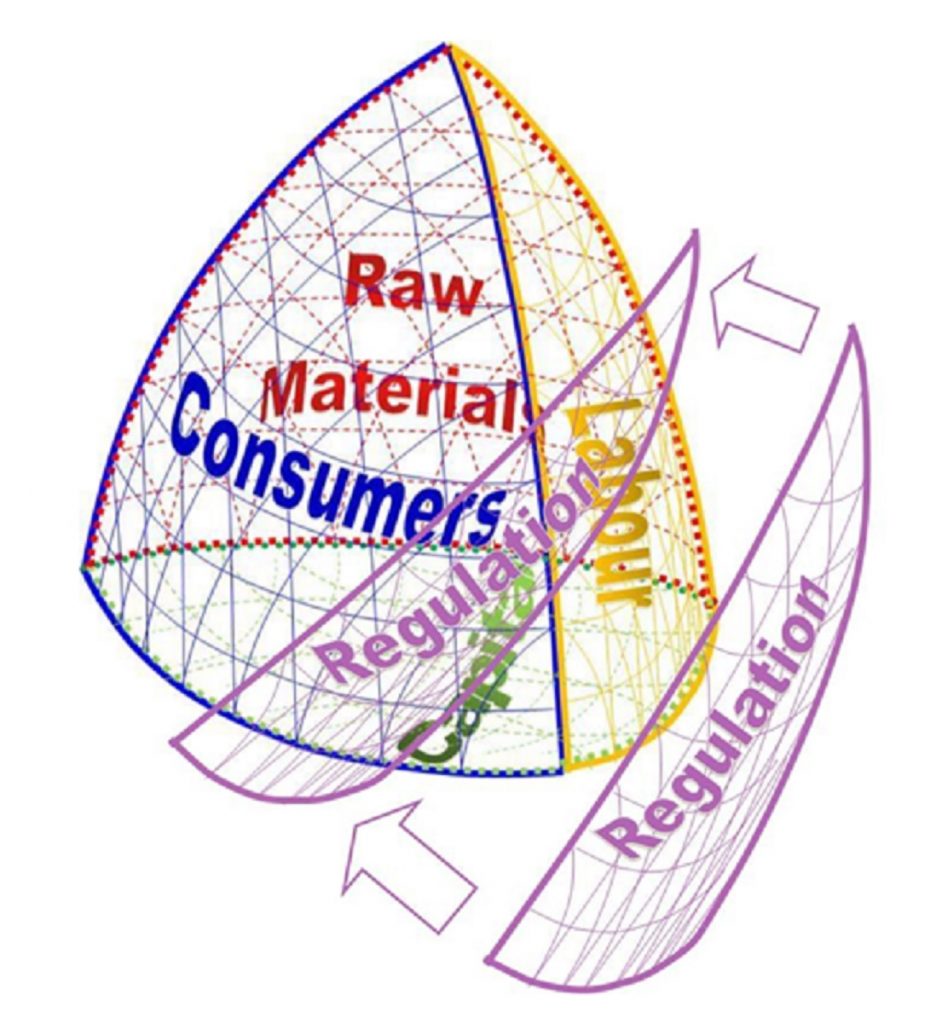

Visualising the organisation within the Escondido Framework, in its most simple form as a Reuleaux Tetrahedron, one interpretation of the employment tribunal decision for Uber is that the interface with the labour market has moved and changed in shape. Alternatively, the judgement could be interpreted as a movement of the interface with the regulatory and political market place that reduces the solution space by limiting the parts of the labour market interface that are available to Uber (ie the self employment part of the interface is no longer available to it).

The outcome is indisputable. The solution space available to Uber is smaller, with a consequence that the latitude in terms of strategy available to its management is reduced, along with the amount of economic available for capture by the management and any other interested parties being reduced.

But assessing which of the market interfaces has changed to reduce the size of the solution space is more complex. Is it that the consequence of the legal judgement is that drivers will no longer be willing – as a consequence of the protection of rights arising from the employment tribunal decision – to work on the mix terms that they would previously have accepted? If so, this would represent a change in the position and shape of the market interface. Or is it that the market interface – which is collection of points representing an acceptable mix of terms of “employment” to drivers (payment, sick pay, holiday pay, employer imposed restrictions on availability, ability to take other work, ability to turn down rides, access to tips from passengers, discretion about routes to take, condition of the car that they driver must maintain etc) has not changed, but that the movement of the interface with the political and regulatory world (the market for political influence, which in Uber’s case may well have been influenced by other aspects of the company’s conduct), has moved in way that has removed some of these points from being available (see illustration below)

[1] Subsequent to this post some very interesting issues arose surrounding the way that Uber has positioned itself against this market interface, giving rise to repeated charges of sexism and sexual discrimination